Getting a mortgage is often a scary process and many young people and potential first time buyers only manage to venture a few tentative steps towards the idea before getting spooked and turning heel. Don’t allow yourself to be discouraged.

Here is a detailed step by step guide to the whole procedure, from starting to consider a mortgage all the way through to moving day. You’ll also find a few handy trade secrets to smooth over the process and a glossary of all the pesky jargon that can leave some people scratching their noggins.

Introduction

After 12 years together and three years living with the mother in law, me and my childhood sweetheart finally got our heads into gear and decided to research a whole new concept. A mortgage!

Yes it took a long time for us to get there but we did get there in the end. Starting a relationship so young has rendered us a bit behind with all these adult steps we were meant to take. We were never in any rush when we were teenagers and the urgency to get things rolling took a while to catch up with us.

The first problem we encountered when we began this journey was that we had no concrete idea of how the whole process works. We knew it was a massive commitment and of course we were aware of the cost but that was the extent of our knowledge.

We have the commitment down, no problem. Our savings account, on the other hand was non-existent for the first 3/4 of our relationship and mostly barren for the remaining time, since we would get a little money saved and decide it was time for a holiday or new gadget.

So with the prospect of our own space, at last, on the horizon, we have been fanatically saving like it’s going out of style. We reluctantly said no to nights out (gasp) and scrimped and saved throughout each month so a good chunk of dosh was stashed away safely at every opportunity. It sucked, but sacrificing things you like for something you’d love is part of life and as we are both pelting towards our thirties at a truly frightening speed it seems about time really.

So the saving was underway and I was focusing all my energy on not ordering a Nurtibullet (You don’t need it, you do NOT need it) while he was forgoing overpriced PlayStation games and buying a lottery ticket every Friday, always the optimist is our Kieran.

The next step was to do some research. Great I can do research. The night after our big “we are going to buy a house” pact, I sat at home and decided to begin.

I hopefully type into Google...

The information that popped up was, frankly, contradictory and confusing! Interest rates and percentages, tracker mortgages and cashback offers. So many sites on comparing which offer was best, you needed an actual comparison site for these sites so you knew how to trust. Where do you begin? This was going to be a quite a learning curb it seemed.

If you are seriously considering a mortgage then you need to get in touch with a mortgage advisor. In our naivety and inexperience we weren’t even sure what an advisor would do. We knew they would know the ins and outs though so that was good enough for us.

So we got in touch and had a meeting, we all sat down together and the mortgage advisor asked all kinds of questions about wage, incomings and outgoing and debt. The whole process took around 30 minutes. She left us knowing then and there her estimation of what the banks would be prepared to lend us and told us that pending a full credit check with a giant tick next to it we would be in the position to start making some offers! Shocking really. Was it that easy? No it wasn’t.

The very next day we were told we had passed the credit check with flying colours. We felt amazing, the saving was in full swing, and we would soon be home owners.

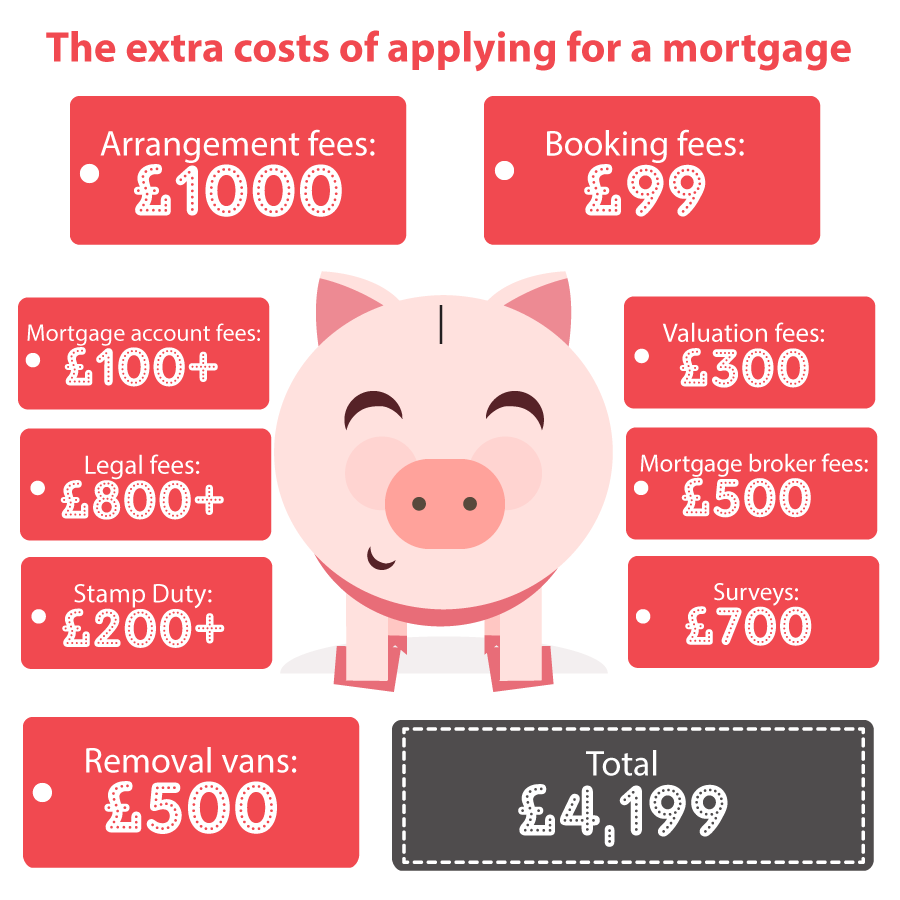

More research allowed us to discover that there were more things to pay for then we first thought. There are mortgage advisor fees, deposit, stamp duty (I’m still not 100% on what this is), moving costs, surveyors and conveyancing. Not to mention the fact that our furniture collection consisted of one bed, two bookshelves, a wardrobe that would most likely fall apart during transit and a PlayStation with TV. So much expense, so little money. So we upped the savings.

After discovering so much conflicting and confusing information on the World Wide Web I decided to pitch the idea of a complete mortgage guide for first time buyers to my boss the next chance I got. He went for it and here it is. I have spent hours online researching, talking to mortgage advisors and just generally trying to get my head around all there is to know. I hope it helps.

Types of Mortgage

A mortgage is a type of loan. The bank agrees to lend you money so you can buy a house. In return for this you must agree to pay interest. The property you buy is then used as collateral against the loan. There are many types of mortgage that you can apply for and they all have pros and cons depending on your situation. It is important to consider what is best for you before you decide which route to go down.

Fixed Rate Mortgages

A fixed rate mortgage is when the rate of interest on the loan stays the same for a fixed amount of time, this means it is not affected by changing rates. The amount of time is agreed upon before and is typically 2-5 years.

Pros-

- This makes it easy to budget as you know your monthly payments will always stay the same.

Cons-

- Fixed rate deals are often slightly more than variable rates due to the security you get.

- If the interest rates fall dramatically a year into a 5 year fixed you are stuck having to pay the higher rates until the term is up.

Variable Rate Mortgages

A variable rate mortgage involves the interest rates going up and down. There are several different types of variable rate mortgage.

Standard Variable Rate

This is the most common form of variable rate mortgage and is applied to most mortgages in the United Kingdom. The interest rate is subject to change based on the interest base rates set up by the Bank of England.

Pros-

- You can overpay and not incur any early repayment charges.

- You often receive lower interest rates as the lender is aware you are taking some risks.

Cons-

- There is a chance that your monthly repayments could rise higher than what you can afford.

Discounted Mortgage

A discounted mortgage is a mortgage that has a lower interest rate than the banks current SVR and is often used to attract people to the lender. They are usually offered for a short time and after this term is over your rates will return to normal.

Pros-

- The monthly payments are smaller for the first year or two

- As it is a variable rate the repayments can get smaller as the SVR get smaller

Cons-

- The lender is free to raise the payments at any time they like so you need to be prepared for the worst.

- If the Bank of England Base Rate goes up then so will your repayments

Tracker Mortgage

A tracker mortgage tracks the rates of the Bank of England and the fees are based on a set margin, so for example, the rate could be 1% more or less. These are generally set up for short terms with a renegotiation required at the end of 1-5 years depending on the agreement.

Pros-

- The interest rates tend to be lower than fixed rates mortgages.

- If the interest rates go down so do your monthly repayments.

Cons-

- The interest rates can also rise with the base rate.

Capped Rate Mortgage

The interest rates of a capped mortgage can fluctuate up and down like as with most variable rate plans. A capped mortgage has an upper limit that stops repayment from going up past a certain level.

Pros-

- You can enjoy the lower interest rates when you can but don’t have to fret that they will rise above your means. Just be sure to check you can afford it if they do rise to the capped level.

Cons-

- The interest rate for this type of mortgage is often higher.

- The lender can raise the interest rate to the cap level at any point and the capped rate tends to be quite high.

Offset Mortgage

An offset mortgage is linked to your savings account. The sum you have saved is used with your mortgage to reduce the amount of interest you pay. So if you have a £100,000 mortgage and £10,000 in savings you will only pay interest on £90,000 of your loan.

Pros-

- You can still access you savings if you need them.

- You will pay off your mortgage faster as you reduce the amount owned with your savings.

Cons-

- If you need to use your savings in an emergency you will have to pay for it in your monthly repayments

Cashback Mortgage

A cashback Mortgage gives you a sum of money once your mortgage is finalised. The total amount can be a percentage of the loan or a set amount.

Pros-

- These can be handy if you are starting from scratch with furniture or if your house needs lots of work doing to it.

Cons-

- You could end up paying more overall for this type of mortgage as the interest rates are often higher.

Current Account Mortgages

Current account mortgages are similar to offset mortgages except the loan is linked to the customer’s current account rather than the savings. So if you have £2,000 in your current account and your mortgage is £100,000 you will pay interest on just £98,000. The daily interest rates change as your current account fluctuates. The more money you have in your account the cheaper your payments.

Pros-

- You have more freedom and control over your interest rates.

- You are likely to be paying off your mortgage at a fast pace.

Cons-

- It is hard to find this type of loan with discounted rate deals.

Other Benefits

Some mortgage lenders give you the option to either overpay or underpay on your monthly payments. You should check with each lender to find out their rules. Overpaying is handy when you have a bit of spare cash and will reduce your payments and the term of your loan. Many lenders like to slap you with an overpayment charge if you do this.

Underpaying is a great way to take some of the pressure off when times are hard, that being said it will prolong your loan and ultimately cost you more.

Another option during hard times is to take a payment holiday. The lenders will carefully consider your circumstances before allowing you to do this and it will be a short term fix that can end up being quite expensive. Typically in order to qualify you will have to previously have overpaid on your mortgage and you must not be in arrears.

Help to Buy Schemes

Most people are aware of the difficulties faced by first time buyers right now, gone are the days of easy lending and mortgages with spare dosh ready for redecorating and expanding. The home buying scene is now a harsh landscape of high interest rates, arrears and even early repayment charges.

The government is well aware of these issues and has come up with a novel way of giving all types of people a shimmy up the ladder. There are two main types of help to buy schemes and they both take a load off the minds of the people they assist.

- Help to Buy Equity Mortgage

- Help to Buy Guarantor Mortgage

This type of Mortgage involves the bank lending the first time buyer an equity loan for up to 20% of the property. So you do have to pay this back however it is interest free for the first 5 years. The buyer still has to supply a 5% deposit and the lender will give them a mortgage for the remaining 75%.

If you went on to sell your home for more than you payed for it you would still have to pay back the bank 20% of what you sold the house for.

This type of help to buy scheme works the same way as any other mortgage except the government offers the buyer the option to purchase a guarantor on 20% of the mortgage. This gives the lender a more secure lending agreement and means they are happier to give out mortgages of 80% to 95% of the value of the property.

In order to be eligible for this scheme you must not own property anywhere else in the world. Unlike the equity mortgage scheme you can purchase any property, be it old or new, so long as it is still under the 600,000 threshold. Your mortgage must be on a repayment plan and you must still plan to live there yourself. Finally your mortgage must be under 4 ½ times your annual income.

Who's Who in the Mortagage Process?

Estate agent

These guys are the main players when it’s comes to buying and selling houses. They deal with the marketing and advertising of properties as well as sorting mountains of paperwork. They also keep an eye on the chain of sale to ensure no one pulls out at the last minute (cheeky sods) and haggle with the seller.

Important questions to ask:

- Has there been much interest in the property?

- Would they live here?

- Is the neighbourhood friendly?

- Is there anything you would like to know if you were buying this house?

- Is there room for negotiation?

- Has there been any major work conducted or does the house need any?

Lender

Lenders are a vital step in the house buying process, as the name suggests they are the guys that actually lend you the funds. Each lender will have a different set of interest rates and products available. It is their job to assess which deal they are happy to offer you.

Important questions to ask:

- Is there an arrangement fee to pay and is it refundable if the deal goes under?

- Is the mortgage portable, are you able to transfer it to another property?

- Are there any early repayment charges, if so how much will they be?

- Is there anything you would like to know if you were buying this house?

- What is the minimum down payment?

- What are the closing costs?

- What is the interest rate? Is this an incentive rate and if so how long does it last and what will be the rate after this period?

Advisor or broker

A mortgage advisor or broker is someone with a detailed knowledge of the market and the entire property buying process (which can be long, expensive and boring). They are there to aid you in making the right decision. This provides some insurance as if you find yourself stuck with a mortgage you couldn’t afford you can complain to The Legal Ombudsman.

Important questions to ask:

- What makes this mortgage the right choice for me?

- How do you charge for your services?

- How much are we reasonably going to be able to borrow and what type of deposit will we need?

- Are you independent or tied to a company? Independent advisors will be able to offer you the best view of the market!

- Are you regulated by the Financial Services Authority (FSA)?

- Do you offer any other services such as insurance advice?

Solicitor

When you begin the process of applying for a mortgage one of the first things you will be asked to provide will be the name of your solicitor. They will then muddle through all the conveyancing for you. This is the term for transferring ownership of a property and involves a lot of paperwork, giving legal advice, transferring the funds and handling the land registry. Take recommendations from friends or colleagues that may have just been through the process as it is very important to find a person that knows what they’re doing.

Important questions to ask:

- How much experience do you have?

- How do you charge?

- Are there any hidden charges?

- How often and by what means will you keep me updated?

- Is there anything I can do to make the process run smoothly?

Surveyor

A chartered surveyor is the person who will visit the house you are hoping to make your home and assess things like value and condition. They can also assist with things like renovation and environmental issues. If any issues are discovered you can use this knowledge to haggle with the price or get vital repair costs taken from the price.

Important questions to ask:

- Which type of survey does the property need?

- What is a reasonable price to pay for this property?

- Are there any defects that are in need of immediate attention?

- How much will these improvements cost?

- Are we in a position to renegotiate the offer on the property?

The Seller

Unlike the other people involved, the seller is not usually a professional in this field, yet they do have a huge amount of sway when it comes to getting you into your dream house. A lot is riding on them and things such as onward chains can slow down the process. You usually won’t meet the seller but if you are lucky enough to get a hassle free mortgage exchange you probably have a lot to thank them for.

Step by Step Guide to Buying

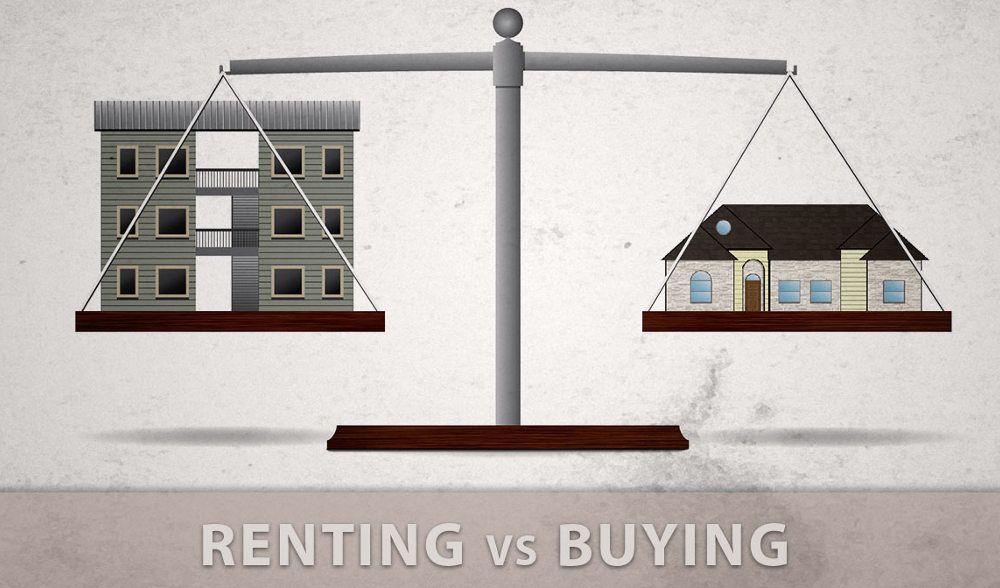

Step one: Should you buy or rent? Which option is best for you?

To buy or not to buy: That is the question!

There are pros and cons to both owning and renting your home. Renting often means expensive house repairs are covered by the landlord plus you are free to move again if circumstances change quickly. On the other hand owning your home means repairs must be covered by you, so good home insurance is vital and another expense.

If you opt to buy you can, within reason, alter your house in any way you wish and have as many people, pets and children living under the roof as you like. Whereas renting leaves you at the mercy of the homeowner and even little things like painting the walls or getting a tabby could mean getting written permission (yawn).

It really comes down to one thing. Are you the type of person who is happy to pay rent on the house you live in without it accumulating any value for you or are you the type of person that wants to forgo making this kind of humongous commitment? This is after all one of the biggest commitments of your life, certainly the biggest financial promise you will ever make.

Kieran and I thought long and hard about what we wanted to do when it came to finally fleeing the nest. The thought of being tied into this contract for 25 years or more is a terrifying prospect at times. Ultimately we realised that our main goal in life was to settle down and do the whole marriage and kids thing and buying a house now was a way of providing security for our theoretical family. We simply wanted a place to call our own.

Be sure to discuss this decision in detail before you go ahead, after a certain point there is no turning back without losing a sizable amount of money.

Step two: What can you afford?

If you decide buying is the way forward then the next puzzle is how much can you reasonably afford?

How high your mortgage can go is a tricky question. It requires the complete breakdown of all your monthly incomings and outgoings (gulp) followed by seeing how much you have left over to play house with.

The first stage in answering this question is to contact a mortgage advisor. They will assess your financial situation and give you a rough guide as to how much lenders will be willing to let you borrow. It is vital to take into account every outgoing and incomings in this meeting as being left with a mortgage you can’t handle would be devastating.

As a very rough guide you will most likely be able to borrow around four times your yearly income. The dreaded credit check is part of the decision process (tugs collar nervously) this will highlight any potential difficulties or marks on your credit report that may affect your chances of getting approved.

Meeting your mortgage advisor for the first time will require a bit of preparation. Expect to have to hand over some back copies of pay checks, proof of identity, proof of any financial commitments and your latest p45.

The factors that affect how much you pay back each month include your initial deposit and we all know the mores the better with this one. The length of your mortgage, this can be 25+ years, the overall coast of the loan increases with each year it takes you to pay it back. Finally the interest rate you get affects the overall coast of the mortgage and the better interest rates are often paired with the smaller mortgages.

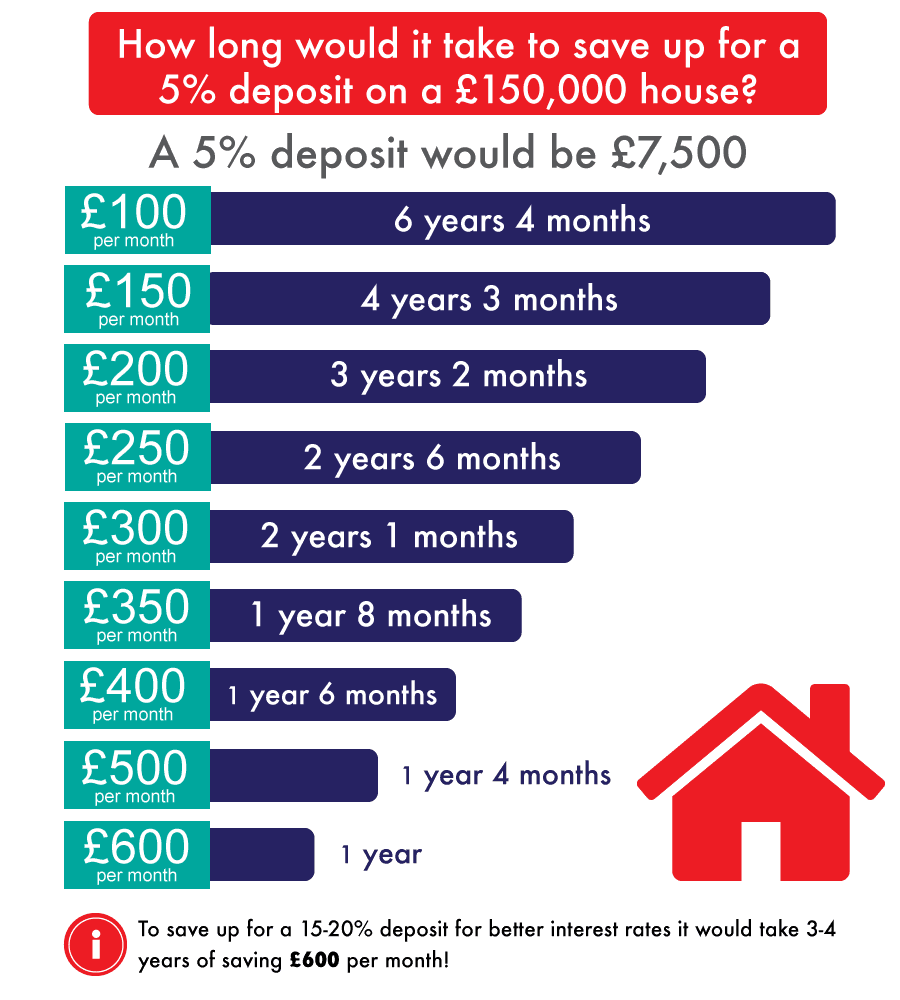

Step three: Saving a deposit.

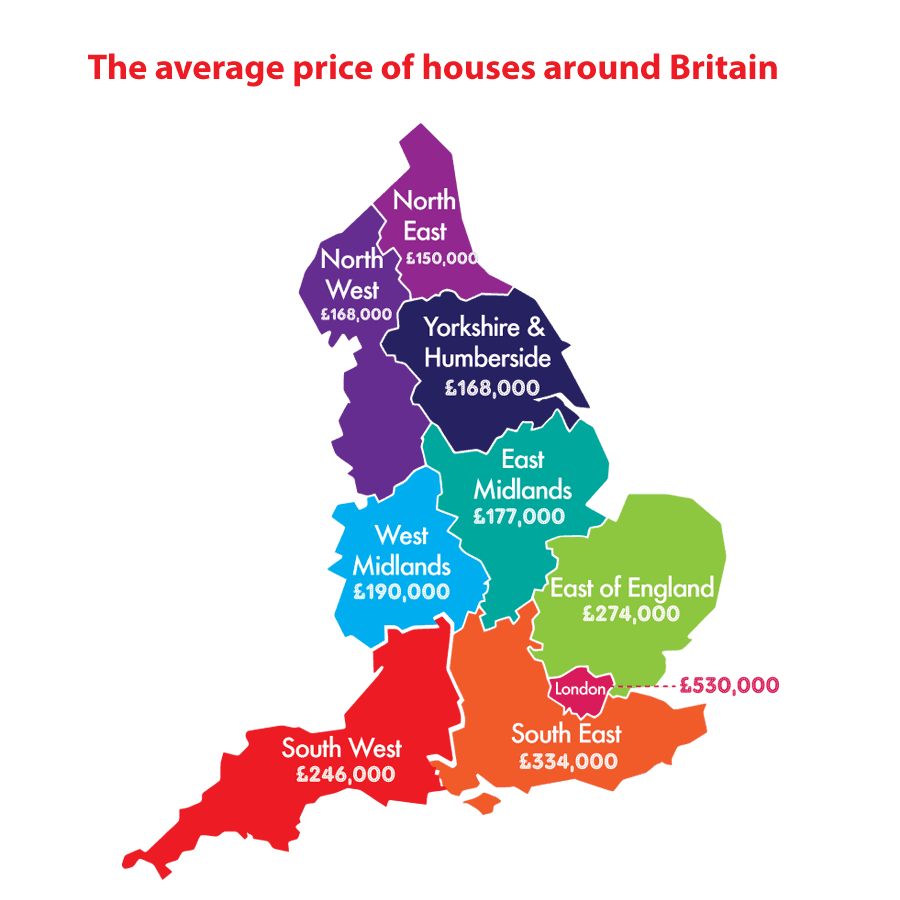

You can buy a house with a deposit as small as 5%. This kind of deposit leaves you with more expensive rates and payments. Interest rates begin getting competitive at around 10/15% and the deals get really good at around 25% deposit. This is roughly £37,500 on a house worth £150,000. Jeez that’s a lot of dosh to come up with. The average house price in England at the beginning of this year was just over 200,000.

Have a look at this handy infographic below to see how much you need to be saving in order to get that deposit together in the time frame you want.

Ways to save:

Annalise your incomings and outgoings and figure out where you can cut back. The truth of the matter is that for many young couples in their 20s today disposable income seems like a necessity we couldn’t do without.

Heaven forbid we not buy the latest disposable fashions or skip a night down the pub with friends. That was my take on it anyway and each month I would squander what little money I did have left on trivial things. I never had anything to show from my irresponsible spending aside from a few ill-advised outfits and some drunk selfies. Here are a few handy tips to hopefully help you start savings some serious money.

-

Learn to say no. Nights out in the pub or going to the cinema are what being in your 20s is about but it can get really expensive! A weekly trip to watch a film with popcorn and a drink (to share) will set you back £26.10. Over the course of a year that adds up to a staggering £1,357.20. Making this a monthly treat would save you over £1000.

Nights on the town can be even more precarious for your bank account. With some people clearing themselves out in a single weekend. Keep an eye out for house parties where a good bottle of wine will amount to the grand scale of your spending and you will sleep better each night.

-

Make a shopping list and stick to it. We learnt this the hard way. Walking into Aldi blind can not only lead to questionable health choices but also to a much bigger bill.

So much food is just thrown away each year in Britain and a simple meal plan has the potential to more than half the issue. So go shopping with a clear idea of what you are going to do with each item and be sure to make the most of all the leftovers. You could end up saving £20/£40 in a single transaction.

- Give it a day. Next time you see something you quite fancy pop it back on the shelf and give it a day before you come back and buy it. You will surprise yourself at how much the urge to buy diminishes once you’ve walked away. Popping the money you would have spent in your savings will see them growing faster in no time at all.

-

Cancel any direct debits that aren’t essential. Netflix is handy and cheap when you having a night away from the pub but do you really need Now TV and Amazon as well? Your gym membership, how much do you use it and is there other ways you can work out without spending money? Check you online banking for any outstanding orders you may have forgotten about.

Whilst saving for my deposit I was hit by £100 annual membership charge for the National Hypnotherapy society and I had no memory of signing up.

- Consider a pay as you go phone bill. This is handy for anyone who regularly exceeds their limit. Many networks now offer great deals on pay as you go phones.

- Research and change your insurance. This is all your insurances from car to household. You never know when their might be a better deal out there and you could save hundreds overall.

- I suffer terribly from eczema on my hands and often have to fork out extra on prescriptions which are now £7.85 per go. This is cheap if you only need visit the doctor once or twice a year. Many people in the UK, however, need to get something each week or a few prescriptions a month.

Getting a prescription prepayment certificate could save these unlucky chaps hundreds of pounds a year as the annual price is £104. This is only £2 a go if you need 4 prescriptions a month.

- Put your money in an Isa. You can save up to £15,240 a year in an Isa and any money you make in interest is tax free.

-

Sell any unwanted or unused items. Old phones knocking around the house can be sold for cash as can any old DVD and games consoles that now just sit gathering dust. A free site such as Gumtree or Facebook is the place to head if you want to unload any old clothes or clutter.

You’d be surprised how much stuff you have hanging around you don’t need. Who wants to cart a load of old baggage to a brand spanking new house anyway?

- Conscious spending was what saved us the most money in the end. How much we wanted to save each month went into a separate account as soon as payday hit. This way we could see what we had left and budget accordingly. We did still go out and have fun we just had to pick only the best events and really think each purchase.

Step four: What type of house do you want/need?

This house is going to be your home and refuge for the foreseeable future so it is vital not to just go for the first thing you see, shop around and find the perfect match.

The internet has made the exercise of house hunting much easier. There are now many companies with handy websites out there such as Rightmove and Zoopla. These allow you to search the neighbourhoods you find appealing and even get a glimpse inside the house before you visit.

As well as looking for the right property you also need to be aware of the neighbourhood. A household planning on starting a family will want to be closer to the good schools whereas a career driven family who like to party hard at the weekends will need an area with good transportation networks and nightlife close by.

A quick check of the crime rate in the area is always a good shout if you are unfamiliar with it and a visit to check out the local scene would always be beneficial.

You need to have a sit down and consider what type of house you need carefully. Do you need a big garden for family pets or an extra bedroom for all your books? Would a new build be the perfect fit or do you relish the character you find in older houses? Does the house have double glazing as it is often expensive to replace. Which council tax bracket do you fall into? So many things to consider!

Step five: Get an agreement in principle. Nothing is set in stone at this point.

Now is the time to actually apply for a mortgage. It would do no good to hunt for a house and find the perfect match only to have the rug swept out from under you once there is a delay and the seller accepts an offer from more prepared origins. It’s heart-breaking!

This is where the agreement in principal enters the mix. It gives you a more solid idea of what you can afford to borrow as well as an understanding of how much the lender is happy to give you.

You should think long and hard about which type of mortgage you would like. There are pros and cons to each payment plan and no one type is suitable for everyone. Keep this in mind and choose wisely. Your mortgage advisor should be able to weed out the bad options and suggest which is best for your budget and circumstances so be sure to utilise their knowledge to the fullest.

Once you have your agreement in principle and have made a decision about the type of mortgage you are ready to actually start viewing properties and, fingers crossed, making offers.

Step six: View the house, be critical, and ask questions, after all you will be giving them a lot of money.

The houses you visit are always going to be hiding behind their Sunday best. After all, the seller wants you to buy the house, as well as making as much money feasible so will therefore strive to only show you the glamour. Don’t be fooled.

When viewing a house it is important to forgo the romanticism of your potential forever home. Instead adopt the keen eye of a critic and imagine it is your job to spot any issues. Never go alone to view a house either, it can be surprising how much another set of eyes notices while you’re envisioning cosy evenings in front of the fireplace.

Another great tip is to take photos of anything that is worrying you. Get a little snap and you can go over the pictures later when the estate agent is not trying to charm you into making a snap decision. Use all your senses as you explore. Enquire about any unusual smells and touch the surfaces to check for damages.

The most important advice to follow is to ask lots of questions. Be the annoying buyer that doesn’t stop asking questions if you have to, you’ll most likely never buy anything more important (or expensive) again.

Step seven: Make an offer.

So once you have found your dream abode you can start making offers. This is where it starts getting both exciting and nerve racking.

The offer should typically be lower than your upper budget as there is sure to be some too and fro going on. All you have to do is give your estate agent a bell and inform them of which house you’re interested in and how much you’re prepared to offer. Then it’s a case waiting for the thumbs up or not. If the offer is not accepted then you have the option to offer more until reach your limit or you get the green light.

As a first time buyer you have a few things in your favour, for starters you’re not trapped in a long chain of buyers and sellers that lead to complications and huge delays. You should also have your agreement in principal handy which proves your offer is good to the seller.

Have a knowledge of the street your property is situated in so you have a rough guide to the value and be sure to insist any damages come off the asking price.

Provided the offer is accepted and all is above board you will then receive a Subject to Survey and Contract written contract. This is the cue for you to formally apply for your mortgage. Ensure you have the following things ready for the process

- Proof of ID

- Proof of address

- P60

- At least 3 months’ worth of pay checks

- Details of any credit commitments

Ask the estate agent to remove the property publicly from the market so as to avoid any cheeky gazumpers coming along and whipping the sale out from under you with a bigger offer.

Wonderful guys, there are not many more things left to go over now and the house is close enough to touch.

Step eight: Conduct surveys and conveyancing. Stamp duty.

Time for the finishing touches in this journey it seems. The reason surveys need to be carried out is twofold. Firstly the lender needs to double check the valuation of the property to protect themselves if the deal falls though. Secondly a home buyer’s survey needs to be completed to ensure there are no hidden damages or things in urgent need of repair.

If you are buying a house worth more than 125,000 then you will need to pay a certain amount of land tax. This is called stamp duty. The sum you pay for a house over £125,000 is calculated in a similar way to income tax. So if you were buying a house worth £150,000 you would pay £500. Conveyancing is the legal term for passing a house from one set of hands to another and your solicitor will sort all this out for you. Dealing with the dreaded paperwork and making everything run smoothing in the eyes of law.

Phew! Still with me guys? Great because things are heading to a close now and if you’ve gotten this far you are soon to be proud owners of your own little place.

Step nine: Exchange contracts and insure the house.

Everything should be running tickety-boo right now with all parties ready to sign on the dotted line. Now is the time for signing the contracts naming you the official owner of the property. You will sign your contract and the seller will sign theirs. The solicitor will then swap the contracts between the two parties and you both sign again.

This is also the time to hand over your deposit and that means there is no going back. A few weeks of waiting for everything to be checked and you have got yourself a house! And Breath...

While this waiting period is going on you may be asked buy your lender to sort out some form of house insurance. This is not a legal requirement however many lenders will not grant a mortgage unless this is agreed upon. They are placing a huge chunk of money into the house and need to know it is protected after all. It is also a massive piece of mind for the buyer who will know their new home is covered from burglary or flooding if the worst should happen in the future.

After the sale

So you have successfully purchased your first house and now find yourself faced with the daunting prospect of uprooting your life and transferring it elsewhere. Moving house can be a stressful experience, all the more so if you leave everything to the last minute. Follow this checklist and it should help you ace this moving malarkey without a hitch.

2-4 months before the move

First things first, book the time you need off work! You will most likely need a week or two to get everything ready.

Many people see moving house as a chance for a fresh start and rightly so. No one wants to move into a new place and have it feeling cluttered from the get go. So start clearing things and sorting through things you don’t need. It is amazing how much clearer your head will feel.

This is also a great time to start packing up some less needed items such as your winter/summer wardrobes or big appliances from the kitchen you only use on odd occasions.

Start letting companies such as the bank and your internet provider know about your move and the date you’re moving. Also set up a change of address notice with the post office so you don’t lose any important mail.

Inform doctors and dentists of your move and arrange to transfer to local ones in your new area if you need to.

Book pets into a kennel or cattery if you need to a few days during the busiest part of the move, also register with a vets closer to your new home.

1-2 weeks before the move

Register to pay council tax for your new home. Change your TV licence. Notify your energy providers of your move and look for the best deal for the new house.

Double check your home insurance to ensure you have the best deal. You never know.

Cleaning is hardly most people’s idea of a good time however you should leave the house in a state you would like to find it so now’s your time to get everything spic and span.

Last day or two

Pack a survival kit for when you get to the other end. It should include thing such as a change of clothes, toothbrush, toilet paper, snacks and of course bubbly for celebrating.

Confirm the removal company are aware of your booking and confirm that the keys to the new place will be available on the right day.

Do a last run through and clean-up of the house including emptying all the cupboards and the fridge.

Pack the last few things aside from a few absolute essentials from the toilet and kitchen. Take down fixtures, fittings and any curtains you were planning on taking with you. Empty the outside spaces of any belongings and ensure all important documents are packed and placed somewhere safe.

The day of the move

Strip the beds and pack the last essentials you couldn’t last night.

Be there to greet the removal men and show them around, all the while keeping their mugs fill with tea. Biscuits are encouraged but entirely optional.

Take a last run through of the house just before you leave to ensure no stray box or sock has been left behind.

At the other end check furniture and boxes for damages as they are moved into the new house.

Once you’re in

Show the removal guys where to place each box and be sure to check the van after they finish unloading for anything left behind.

Start by unpacking the beds first as you need a good night’s sleep.

Enjoy your new house. Oh and don’t forget to say hello to the neighbours.

Tips and Tricks

This section is dedicated to some of the tips and tricks I picked up along the way. Each nugget of wisdom was included in the hope it will make your experience easier at every hurdle. I was even fortunate enough to get a few suggestions from some experts and these have been added at the end of this section. As with every part of this piece, I really hope it helps you a little.

-

Consider carefully when you should buy! It is a huge commitment buying a house and it will get repossessed if you don’t keep up with the payments!! Be 100% confident you can make the payments every month. The lender will think nothing of slinging you out by the ear and reselling your family home.

Consider if it is worth saving up for a larger deposit first, it could save you, not just extra pennies each month but a shed load of cash over the course of the years.

-

Place your savings in a Help to buy ISA. These will be available from 1st December 2015 and are a great way of keeping your savings growing. For every deposit you place in your account the government will top it up by 25%.

So for every £200 you save you will receive £50 from the government. You can also place £1000 in the account as you open it, which means you would get £250 right off the bat. The most the government will give you is £3,000 which would bump your £12,000 savings up to £15,000.

-

Boost your credit score, small things can really impact the results. If you have bad credit then consider getting a credit card designed for poor credit, if you are sensible with it you can improve your score.

Close any credit cards you don’t use, closing accounts look really good. Register to vote if you haven’t already. Don’t apply for credit too often as this leaves a footprint that can make you look like you are desperately seeking credit.

- Don’t just take the most money they offer, it all depends on how much you know you can afford to borrow. Can you afford to spend over £1000 on your mortgage?

- Take lots of photos when you view the house. The estate agent will want to whisk you around the property at a fast rate so you have less time to notice any damages or less than satisfactory issues. Taking lots of pictures may provide you with evidence of a problem that has been missed during your viewing.

- View at different times of the day. This serves to give you a feel for the house and the neighbourhood at every time of the day and night.

- Consider resale potential. Ensure you won’t lose money if and when you decide to move on.

- Learn how much to offer. Never go in with an offer for the asking price. You never know when a seller just wants the house gone and will accept lower offers. Never offer at the top limit of what you can afford either, if you find you dream house and your highest offer is rejected you will simply have nowhere else to go in terms of haggling and will just have to look elsewhere.

- Be sure to get all promised fixtures and fittings in writing or you could turn up in your newly fitted kitchen to find it is no longer there and there will be nothing you can do about it.

- Get the right survey and get quotes for work that needs to be done. This way you will be aware of all the issues and can take the costs off the price of the house if need be.

- Check your council tax band and contest it, you never know how many households have been left paying the wrong council tax band.

- Check flood risks and get insurance quotes before you seal the deal. Properties on land with a risk of flooding are likely to be much more costly to insure.

I got in touch with some independent mortgage brokers and asked them what they would suggest to first time buyers.

David Hollingworth suggested...

Work out what your likely budget will be taking into account the funds you have for a deposit but not forgetting the other costs of buying a property such as survey, legal costs and possibly stamp duty. Then look at what you can realistically borrow which means you’ll need a good handle not just on what you earn but also your monthly outgoings. Then you can see whether the sums add up and that you are aiming at the right kind of target property value and won’t be overstretching.

David Hollingworth at London & Country Mortgages

Pete Russel was very helpful and suggested...

Hurdles I am faced with 1st time buyers and all buyers at the moment is lenders are using computers to obtain a "Credit Score" it’s a case of computer says yes computer says no!! With no human intervention after that from the lender as to why or what. Failed the score, it’s just "NO" go away come back in 12 months and try again.

Too many searches for car insurance on the online compare sites can damage your credit score. When you hit search for a quote, as many as 40 credits searches are simultaneously completed with insurers. You now have 40 points against you so these are deducted from your score reducing the chance of getting a mortgage. Use 3 sites to get comparisons, you now have 120 points deducted from your score.

If a buyer came to us and we find this is the problem, we look at lenders who do not use the computer score system, these tend to be the smaller building societies.

TIP: If you think you will need to apply for a mortgage in the next 12 months, do not use the online comparison sites for products such as insurance, credit cards, loans, even some mobile phone contracts credit search you. Any site that conducts a credit search on you unless it’s one single search.

Late or missed payments on mobile phones are a big hindrance to obtaining a mortgage. And not just mobile phones any credit that you may have. If you are not able to make the payments to a small item, it’s in a lenders mind, how are you going to make the payment for a big commitment such as a mortgage. So a decline for most lenders, come back in a year or two!!

TIP: Make sure you do not miss or make late payments when due on mobile phones or other credit.

The more deposit you can put down, can increase your chance of getting a mortgage. Less risk to the lender, makes you more favourable to the lender, and the more deposit the lower the rate you can secure. There are a few lenders that will lend with just 5% deposit, but the criteria for those is very harsh and tight, and the interest rates much higher. If you borrow to fund the deposit, this will work against you, as existing loans reduce the amount you can borrow for a mortgage. So counter active, and the loan rate will probably be higher than the mortgage rate so not wise to try that option.

TIP: Best option would be to save and have at least a 10% deposit, plus extra to cover costs such as valuation, arrangement fees and legal fees.

Pete Russell, Director at The Mortgage Warehouse & The Insurance Warehouse

Mortgage Glossary

A-Z of Mortgage Terms

APR

APR stands for annual percentage rate. It is designed to be a standardised way of measuring the total cost of borrowing and includes both the interest rate and annual fees if there are any. You do need to be careful if you are not planning on having the mortgage for the full term however as this is how it is figured out.

Arrangement fee

This is the charge for setting up your mortgage. Some lenders do let you add this to the cost of your mortgage but this means you will be paying interest on this fee for as long as you have the mortgage. This can be up to 25 years.

Arrears

Arrears is a scary term and means you have missed at least one month’s payment on your mortgage. It is vital that you contact your lender at the earliest opportunity if this happens as if you miss too many payments your home may be repossessed.

Bank of England Base Rate

Also known as the BOEBR. This is the rate of interest that is set out by the Bank of England and is there to be a guideline for other lenders.

Building insurance

Insurance to protect your house and yourself from things such as burglary, fire or flooding. In many cases you will find you get better deals if you purchase this from a different company than the one that sorted your mortgage.

Buy-to-let

A buy-to-let Mortgage is exactly what the name suggests. You are eligible for a Buy-to-let mortgage if you are buying with the sole intention of renting out the property. This can be quite a pricy thing to do for a number of reasons. It is seen as a more risky way of lending by the leaders as for most people this would be their second mortgage and it may become difficult to keep up with repayments if customers struggle to let the house.

Capital

This is the amount of money you borrow.

Caped Rate

This means that your mortgage repayments and interest rate can’t go above a certain point even if the Bank of England Base Rate reaches higher.

Cashback Mortgage

This is a type of mortgage where the lender gives you cashback on completion. This is handy as it can be used for house repairs and decoration however this type of fast cash can end up costing you more in the long run!

CCJ

CCJ stands for county court judgement. This happens when an individual has failed to pay off some outstanding debts and may appear on your credit score or report. These can make it more difficult to get granted a mortgage.

Collateral

This is the property. The lender will sell the house to pay back the loan if you can’t keep up with the repayments.

Contract race

This occurs when the property has two or more perspective buyers and the owner agrees to sell to the person who is ready to complete the sale first.

Conveyancing

Conveyancing is the legal policies and processes involved in the selling of property. It involves a lot of paperwork and a knowledge of the subject.

Deposit

This is the amount of cash you have to put down against the value of your house. In years gone by you could get a mortgage without putting down any money, this is not the case today. Today a 5% deposit is needed with the offers steadily improving the more you have up front.

Early repayment charge (ERC)

Believe it or not guys there are charges on your mortgages if you are in the position to pay it back earlier. This can be between 1-3% of the amount of loan you have to pay off. It seems harsh but at the end of the day the bank needs to make a living and they go into this agreement with the knowledge that they will have made a certain amount of profit at the end.

Equity

This is the amount of money you would have if you sold the property and payed back your loan. If the money made from selling your home doesn’t cover the value of your loan you are in negative equity. When the house prices fell a lot of people found themselves in this situation. This is part of the reason a deposit is now required.

Essential repairs

These are the repairs that must be completed before the mortgage can be finalized.

Final reminder

The letter that is delivered before legal proceedings are put under action if your payments are in arrears

Freeholding

You are buying a freehold if you not only own the property but also the land it is built on.

Gazump

This is the word given to the rather cheeky practice of making an offer on a house that someone else has already had their offer accepted on. If the offer is higher you usually win the house by gazumping the other buyer.

Guarantor

Popular with first time or low deposit mortgages, a guarantor is someone who agrees to keep up with the repayments if the buyer cannot. Generally this person will be a parent or close family member.

Higher Lending Charge (HLC)

A higher lending charge is sometimes imposed as assurance against a buyer who is borrowing more than a set amount, often 75%, of the value of their desired properties. This covers the lender if further down the line they have to sell the house as well as covering possible repossession fees.

Homebuy Schemes

These are developed with the goal of helping people, particularly first time buyers, get on the property ladder. They come in many forms and help in many different ways.

Land Registry

The official government body that keeps records and data of property ownership in Britain.

Land Registry Fee

The fee due in return for registering yourself as the new owner of your house.

Loan to value (LTV)

This is the percentage of your house’s value that your mortgage covers.

Monthly repayments

This is the amount of money it is agreed that you will pay back each month. This is agreed for a set amount of time and can then re-evaluated after this time is up.

Mortgage agreement in principle

This is a piece of paper stating how much you will be able to borrow from the bank. Buyers can use it as proof to a seller that they can afford the property in question.

Mortgage deed

The contract you sign outlining all the legal requirements and guidelines of the sale between buyer and seller.

Mortgage term

The amount of time it has been agreed it will take you to pay back the loan.

NHBC guarantee

Offered by the National House Building Council this 10 year guarantee ensures new build major house repairs are covered by the builders.

Payment Protection Plan

This insurance covers you if your circumstances change suddenly and you find yourself unable to pay the mortgage. An example of circumstance would be death, illness and job loss. This insurance is great short term but will only cover the cost for a set amount of time.

Portability

If a mortgage is portable it means that you can move house and simply move the mortgage rather than pay off the old one and taking out a new one. This can be handy as it would save a lot of hassle however moving into a more expensive property may be difficult.

Remortgage

This is when you get another mortgage without moving properties. You do have to pay back the first loan however. This can be done for a number of reasons, such as taking advantage of a better deal or interest rate or even as a way of releasing equity on the house. Releasing equity on the house should be done with some thought as at would put you back further in the repayment.

Shared ownership

The shared ownership schemes were designed to help people who otherwise would not be able to get their feet on the property ladder. The local housing association will own a percentage of the property you buy and the home buyer will pay rent towards this as well as paying back some of their smaller mortgage.

Tie in period

This is the amount of time you are locked into your mortgage agreement

Transfer deed

The legal documents showing the transfer of a property for the local land registry.

Valuation

This is required as proof that the house you are trying to buy is worth the loan amount you are trying to borrow.

There you have it guys. I hope this guide has included all the things first time buyers, such as myself, are struggling with. If I’ve left anything out then feel free to get in touch - @VCP_Rebecca. I consider myself quite savvy when it comes to buying houses now although I don’t consider myself an expert, far from it.

Most importantly I really hope this piece has blown away that pesky fog of puzzlement that surrounds so many of us when we move onto the next chapter of adult life. Moving house is definitely up there with marriage and babies in terms of confusion and the potential to overwhelm the unprepared. A little knowledge can take you a long way.

Happy house hunting guys. I hope you find the perfect place to build some happy memories.